The Beginning of the end

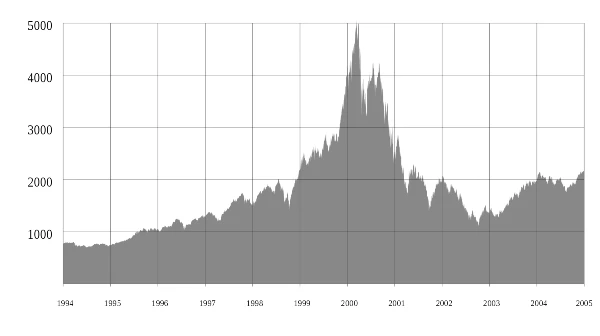

The disappearance of traditional banking won’t happen over night, but it is starting to happen whether most of us recognize it or not. I like to use the internet for comparison. The dot-com bubble peaked in 2000, crashed hard going into 2001 and then internet stocks generally stayed stagnant for a few years.

The NASDAQ composite index peaking during the dot-com bubble and then popping. Source: Wikipedia_

It’s hard to imagine that people backed off of tech investments during that time given what we see today in tech. Investments during the dot-com boom were quietly building up the next generation of the internet. The crash and then the quiet period after were when promising companies from the dot-com boom started to fight through the noise and become strong (e.g. Amazon, Google, Netflix, Salesforce) and new companies started to sprout (e.g. Facebook, YouTube, Shopify). I think a similar cycle is happening in cryptocurrency/blockchain.

In 2017 we had crypto hysteria (ICOs, anyone?) and by 2018 we had the crypto winter that carried on a couple years.

![BTC/USD price index before and after the dot-com bubble popped] BTC/USD price index before and after the dot-com bubble popped](/images/posts/btc_chart.webp)

Bitcoin hit $20k just before 2018 and then fell drastically, along with most of the crypto markets. Source: TradingView

During that “winter” there were new blockchains being built, many based on funding from 2017. Bitcoin, Ethereum, and other pre-2017 smaller cap cryptocurrencies were not going away, even though their value dropped up to 90% from their all time highs. Fast forward to today and Bitcoin’s USD price has crossed $60k, Ethereum’s price has crossed $2k while being the number one blockchain for DeFi, and newer blockchains like Polkadot, Cardano, Cosmos, Elrond, and more are live or going live in 2021.

Arthur Hayes has an informative and funny post up about how traditional banks are mostly struggling ever since the 2008 meltdown while cryptocurrency is changing banking as we know it. Outside of most loan types, Hayes details how crypto is better than the current traditional bank offerings. He goes further to point out that the costs built into today’s banking system are blown up by the economic model of blockchains like Ethereum. The entire article is worth a read.

Does this mean that we’ll all be doing our banking on the blockchain within a year? Not a chance. But the disruption of banking is happening right now. Just as the internet took time to expand in ways that most of us couldn’t imagine after the dot-com bubble burst, cryptocurrency and blockchain are starting to do the same. It’s early days, but banking as we know is coming to an end.